when does alimony end in pa

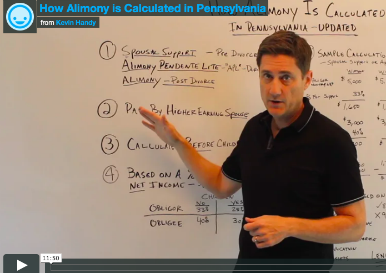

In Pennsylvania there are three types of alimony or spousal support. This is another subjective ruling based on a number of factors brought up in court.

The Basics Of Alimony In Pa Relevant Factors How It Works Etc The Martin Law Firm

Rather than following Pennsylvanias alimony laws a judge will uphold the terms of your agreement instead so long as they are valid.

. It can continue after a divorce decree is entered through an appeal to the Superior Court of Pennsylvania although such appeals are rare. However the paying spouse may still be obligated to continue making as many of those payments as possible after death depending on the court order. Standard for Modification of Indefinite Alimony.

Alimony length is usually based on length of marriage - one commonly used standard for alimony duration is that 1 year of alimony is paid every three years of marriage however this is not always the case in every state or with every judge. Every couples divorce and alimony arrangement will differ based upon their unique circumstances and the agreement they reach. When a court orders indefinite spousal support i.

Alimony then is any support you receive once your divorce finalizes. Marriages can end without either partner being at fault. In negotiating alimony in divorces It is important now that the parties keep in mind that alimony no longer has any tax consequences for either party.

Spousal support is the preferred. The law in Pennsylvania states that no spouse is entitled to receive an award of alimony where the spouse subsequent to the divorce pursuant to which the alimony is being sought has entered into cohabitation with a person of the opposite sex who is not a member of the spouses family within the degrees of. You and your spouse may have drafted a prenuptial agreement before your wedding or a postnuptial agreement afterward.

These are cash dollars paid post-divorce to the lower income andor wage-earning spouse of the formerly married couple. 1 spousal support paid after the spouses separate 2 alimony pendente lite refers to a temporary order for support that is made after the divorce is filed and 3 alimony spousal support paid after the divorce is final. A paying spouse may file a motion to terminate alimony as soon as he or she learns of the supported spouses remarriage.

When Does Alimony End. Its a fact that two households are more expensive to run than one. With the passage of the Tax Cuts and Jobs Act of 2017 and continuing until at least 2025 these payments are a non-taxable event.

In general alimony pendente lite APL is paid during the pendency of a divorce from the time a lower-earning spouse formally requests it until a final decree in divorce is entered. A rule of thumb of one year of alimony for. Alimony payments will typically end when the receiving spouse gets remarried or moves in with a new romantic partner.

In many PA county courts there is an unspoken rule of thumb not a law that a recipient should receive one year of alimony for every three years of marriage. Spousal support is available to a dependent spouse after the couple separates and ends when one spouse files for divorce. There is no specific law on the books in Pennsylvania to determine alimony length.

First alimony is a bit of a misnomer. They can begin this process by filing a court form known as a petition for termination of spousal support with. E support without a predetermined duration or when parties enter into a court-adopted settlement for indefinite spousal support a payor must petition a court to reduce or terminate alimony.

The duration of payments is determined by a judge in Pennsylvania family court. If you feel like you are being taken for granted in sending off a check every month or every two weeks or even every week take heart because the end will come. How Marital Misconduct Affects Alimony.

However I always tell my clients that this is not a slam dunk for an alimony claim. Often times you simply grow apart. By Stark Stark on June 16 2014.

So in this case alimony is not meant to unjustly enrich one party or penalize the other. Alimony in Pennsylvania automatically terminates upon either spouses death or the supported spouses remarriage. When Does Alimony End in Pennsylvania.

So Pennsylvania alimony exists in part based on the needs of the recipient party once the marriage is over and divorce is final. For the purpose of this post were going to discuss alimony and when it ends. In Pennsylvania alimony refers to the financial support paid from one ex-spouse to another once their marriage ends and divorce is final.

Pennsylvania is unique in that the law permits judges to award two kinds of support before finalizing the divorce. First lets take a moment and make sure we are on the same page when we use the term alimony. Each state has established its own laws in regards to child support.

Factors in awarding alimony. In the case of remarriage a court-ordered alimony award is terminated automatically upon the receiving spouses remarriage. Divorces with alimony concluded before January 1 2019 were subject to the former rule of the alimony payments being taxable.

As of that date alimony payments are neither taxable nor deductible. However if the couple settled outside of court the divorce settlement must include a statement terminating alimony upon remarriage in order for it to end. Generally speaking however the paying spouse will need to obtain approval from a court before they will be permitted to stop paying alimony.

They will also usually end when either spouse passes away. However if a child does not graduate high school until they are 19 the non-custodial parent. In Pennsylvania parents have to support their children until they are 18.

In Pennsylvania there are three types of alimony or spousal support. Under Pennsylvania Code Section 3701b a court can take the marital misconduct of your or your spouse into consideration when deciding if alimony is necessary and if so how much and for how long. Like other states Pennsylvania law requires that both parents financially support their children even after they are divorced.

1 spousal support paid after the spouses separate 2 alimony pendente lite refers to a temporary order for support that is made after the divorce is filed and 3 alimony spousal support paid after the divorce is final. Alimony payments are no longer tax deductible for the paying spouse or reportable income for the recipient as of January 1 2019. Alimony pendente lite is available to spouses after someone.

Spousal support and alimony pendente lite. Alimony is not calculated by a formula in Pennsylvania. Pennsylvanias spousal support formula was revised to reflect the changes in tax law and judges will consider the new tax laws when calculating alimony by Pennsylvania divorce laws alimony.

Most divorce agreements in PA do include such a provision.

Alimony In Pa In 2022 Definitive Guide To The Biggest Sticking Points

Will I Have To Pay Alimony Dads Divorce

Can You Get Permanent Alimony If You Are Still Young In Divorce In Orlando Fl Sean Smallwood P A

Alimony In Pa What Can You Expect To Pay

Understanding Alimony In Pa In 2022 And The Challenges Of Resolving It

How To Avoid Paying Alimony Men S Divorce Podcast Men S Divorce

Alimony In Pa In 2020 Definitive Guide To The Biggest Sticking Points Divorce Support Alimony Divorce

Alimony In Pa In 2022 Definitive Guide To The Biggest Sticking Points

Alimony In Pa In 2022 Definitive Guide To The Biggest Sticking Points

Rehabilitative Alimony 2021 Florida Family Divorce Law

Indian Law About Alimony Rights Property Lawyers In India Alimony Hindu Marriage Act Legal Help

Will I Be Awarded Alimony Or Spousal Support Alimony Divorce Divorce Support

The Basics Of Alimony In Pa Relevant Factors How It Works Etc The Martin Law Firm

Understanding Alimony In Different Divorce Scenarios M Sue Wilson Law Office

Alimony In Pa In 2022 Definitive Guide To The Biggest Sticking Points

When Can You End A Lifetime Alimony Sadek And Cooper Family Law

Alimony In Pa In 2022 Definitive Guide To The Biggest Sticking Points